On March 11th 2020, the World Health Organization officially declared the Novel Coronavirus, COVID-19 as a pandemic. While the extent to which the virus may have the ability to disrupt the economies of the world is yet to be ascertained, it has come at a time where the global economies are already facing multiple challenges, such as the collapse of oil prices and the limited or stunted growth. Globally, liquidity has been hit hard, with businesses reining in plans of growth or expansion as consumers are hurried into the safety of their houses. The virus has disrupted supply chains, impacted sales and business development requiring inter-country travels and forced states to consider closed door policies.

The objective of the Targeted Economic Support Scheme (TESS) is to reduce the repercussions of the COVID-19 pandemic. It is intended to:

“(1) facilitate the provision of temporary relief from the payments of principal and/or interest/profit on outstanding loans for all affected private sector corporates, SMEs and individuals. The TESS does not apply to outstanding loans of government, government-related entities (GREs) and non-residents;

(2) facilitate additional lending capacity of banks, through the relief of existing capital buffers; and

(3) outline expectations and the actions to be taken under the TESS by all banks and finance companies operating in the UAE.

The CBUAE further mandates that banks and finance companies who avail of the assistance under the TESS shall comply with these Standards in both words and spirit, which would lead to achieving the overarching policy objectives of the scheme.” [1]

[1] “The Standard for Central Bank of the UAE’s Targeted Economic Support Scheme – Terms & Conditions for all Banks and Finance Companies under the jurisdiction of the Central Bank of the UAE effective from 15.03.2020″

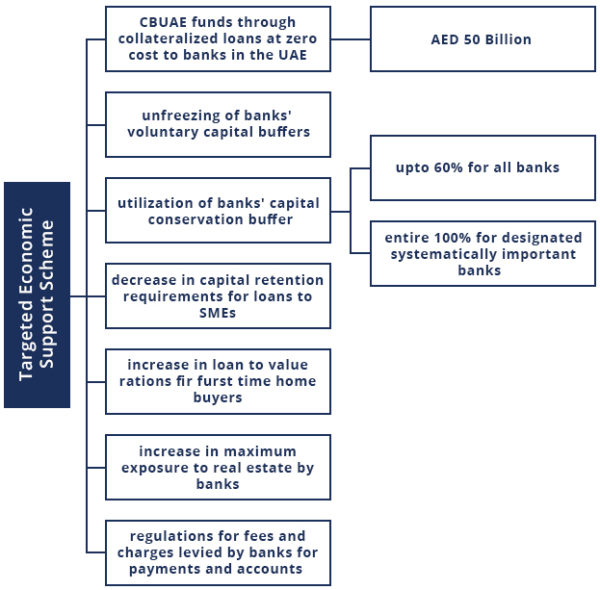

Learning from the developments in other countries, the Central Bank of the UAE (“CBUAE”) has adopted a series of economic measures in order to protect businesses, consumers and other participants of the economy. On 14th March, within 3 days of the WHO’s declaration, the CBUAE announced the Targeted Economic Support Scheme (“Scheme”) which makes available AED 50 Billion for the revitalization of the country’s economy in these trying times. As the virus has slowed economic gains and crunched available cash in hand for both private sector companies (for example retailers globally have been affected as a climate of social distancing is being adopted) as well as consumers, the scheme aims to provide temporary relief to the repayments of principal/interest on outstanding loans. The Scheme shall be operational for a period of six months (upto 15th September, 2020). Other measures adopted by the CBUAE is the waiving of any fees it charges for the operation of the payment and settlement systems within the region. The CBUAE expects that banks retain the standards of lending despite the increase in capital availability, and not dilute the benefits from the Targeted Scheme by granting loans which may seem attractive, but may end up as non-performing.

The Scheme unfreezes the significant voluntary capital buffers which participants in the UAE Banking Sector maintain over and above the minimum prudential norms that are mandatorily imposed. All banks in the UAE are now permitted to utilize upto 60 percent of their capital conservation buffers, while those designated as Domestic Systemically Important may utilize the entirety of the buffer. Requirements to retain capital in loans to small and medium enterprises are also set to decrease by 15 to 25 percent. This measure is still in line with the Basel standards and shall lead to greater access to capital by such enterprises.

The CBUAE also plans to increase the loan to value ratios for first time home buyers by 5% points, benefitting first time buyers as they do not have to put less of their own capital whilst making a purchase. In the real estate sector, the CBUAE is set to revise the current limits on the exposure banks may have to the sector. Banks may increase their exposure to the real estate sector to 30% when such investments make up around 20% of their loan portfolio. However, there are capital retention requirements with such increased exposure.

The CBUAE is expected to issue guidelines on margin calls by banks before liquidation of pledged stocks, preventing excessive market volatility and affording enterprises the breathing room in order to revive themselves from the brink of financial ruination. The CBUAE has also set its sights on the interchange charges charged by banks when retail customers utilize plastic over cash to pay for transactions. Furthermore, bank fees chargeable to SMEs are also under review, and the new regulations shall include provisions such as caps on minimum account balances, etc.

Given UAE’s status as a global hub for fintech, travel, and retail, the consequences of a viral pandemic or a reaction to the same could have potentially disruptive consequences for the participants of the economy. In light of the general situation around the virus, such economic measures can also allow citizens and residents of the UAE to be able to adopt pandemic prevention norms without excessive worry of ruination due to economic cessation. In these trying times, the CBUAE has established itself as a vigilant sectoral participant and promoted confidence in robustness of the UAE financial ecosystem. Nonetheless, the CBUAE has given some source of relief by assuring the people that they will continue monitoring the situation very closely, and are prepared to take further steps, if necessary.